```html

Tiger Cash, abbreviated as TCH, is the platform token issued by CoinTiger Exchange, a decentralized blockchain digital asset based on Ethereum. TCH was officially launched on November 15, 2017, with a total issuance of 1.05 billion. Since its launch, 50 million have been repurchased and destroyed through secondary markets, leaving the current total at 1 billion.

Starting from September 3, 2018, CoinTiger introduced an equity mechanism for TCH, meaning that holding 1 TCH is equivalent to owning one share of CoinTigers equity, with no less than 50% of the annual net profit being distributed to all TCH holders. The previous mechanism of using 50% of profits to repurchase and destroy TCH has been abolished. Under the new rules, TCH users holding more than 1% (10 million) of the total can apply for a shareholder registration change with CoinTigers Singapore company.

I. Introduction of Equity Mechanism for TCH

1. The CoinTiger Singapore Foundation and CoinTiger Singapores main company jointly decided to allocate the shareholder rights originally held by the foundation to all TCH users, meaning that all the benefits of CoinTigers equity previously held by the foundation and company controllers will now be collectively owned by all TCH holders.

2. CoinTiger will distribute no less than 50% of its annual net profit to all TCH holders, abolishing the previous mechanism of using 50% of profits to repurchase and destroy TCH. Currently, CoinTigers revenue structure includes new coin listings, trading commissions, ecosystem funds, Labs, providing one-stop exchange solutions externally, and offering liquidity management services externally.

3. TCH holders will enjoy all voting rights of CoinTigers shareholders meeting according to their proportion of TCH holdings. The specific powers of the shareholders meeting are detailed in the shareholders meeting chapter. As of the date of this announcement, the total number of TCH is 1 billion (total issuance of 1.05 billion, with 50 million already destroyed). Under the new rules, TCH users holding more than 1% (10 million) of the total can apply for a shareholder registration change with CoinTigers Singapore company. CoinTiger will implement a quarterly change and disclosure under the new rules, with the most recent change date being December 31, 2018. CoinTiger will create a subsidiary smart contract to facilitate TCH user inquiries about shareholder registration changes.

II. Board Governance Structure

1. CoinTigers governance has shifted from foundation governance to board management, subject to supervision by TCH holders.

2. CoinTigers board will consist of 11 individual directors, including 7 shareholder directors and 4 community directors. Both shareholder directors and community directors will be elected by the shareholders meeting and enjoy all rights as directors.

3. Considering the upcoming end of the first board term, the rules after this transformation will apply to the second and subsequent boards. The election and determination of each board member will be disclosed according to the rules.

III. Other Related Governance Regulations

1. The CoinTiger Singapore Foundation holds 12% of TCH, with 20% unlocked annually as per the white paper, to be fully unlocked over 5 years. Through this adjustment, the foundation has voluntarily extended the lock-up period to 8 years, with the first unlocked TCH voluntarily locked for another year.

2. Management (above the director level) and board members must not fall below the minimum holding requirements during their tenure. After their terms, they can freely trade, but any reduction in holdings requires at least a two-week advance notice. The announcement should include the estimated percentage, quantity, price range, and purpose of the reduction, with specific formats to be specified.

3. TCH holders must complete real-name verification before registering for dividends on the registration day (voting is unaffected).

4. Shareholders holding more than 5% of TCH must issue an advance announcement before reducing their holdings, unless they have previously voluntarily declined to become CoinTiger shareholders. Specific announcements regarding reductions will be specified separately.

5. The board reviews CoinTigers financial budget and profit distribution plan annually, submitting the results to the shareholders meeting. The annual profit distribution ratio shall not be less than 50% of the net profit, with dividends paid in mainstream currencies such as BTC and ETH. CoinTigers operating conditions shall be publicly disclosed at least once every six months.

6. A CoinTiger Supervisory Committee will be established, hiring community users for supervision and inviting external third-party institutions for evaluation.

7. We are committed to building a highly autonomous organization characterized by transparent governance, clear finances, standardized systems, well-defined responsibilities and rights, and community oversight.

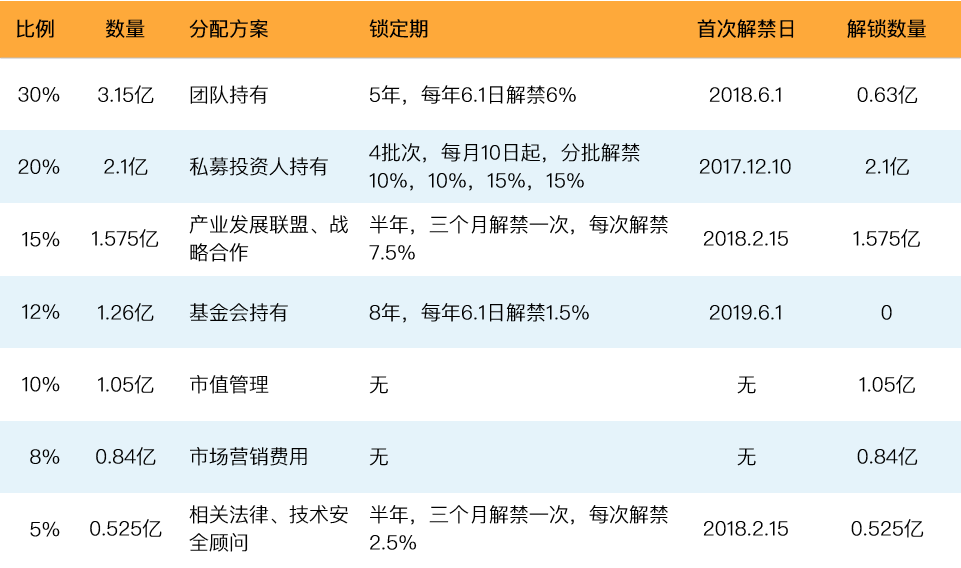

IV. TCH Distribution Plan

All information above comes from the official TCH website.

Related Links:

https://cointiger.zendesk.com/hc/zh-cn/articles/360010735174-CoinTiger%E5%B8%81%E8%99%8F%E5%85%B3%E4%BA%8ETCH%E5%BC%95%E5%85%A5%E8%82%A1%E6%9D%83%E6%9C%BA%E5%88%B6%E7%9A%84%E5%85%AC%E5%91%8A

https://cointiger.zendesk.com/hc/zh-cn/articles/360010825054-TCH%E5%BC%95%E5%85%A5%E8%82%A1%E6%9D%83%E6%9C%BA%E5%88%B6%E5%90%8E%E7%BB%AD%E7%BB%98%E5%88%99

```

Note: The image source URL and the related links have been left unchanged as per the instruction to not alter the HTML format.